- Appointments

- Awards

- Bills & Acts

- Books & Authors

- Committees

- Deaths

- Defence

- Economic

- Environment

- Finance

- Important Days

- International

- Miscellaneous

- National

- Persons in News

- Places in News

- Regional

- Reports

- Resignations

- Science & Technology

- Sports

- Union Budget 2020-2021

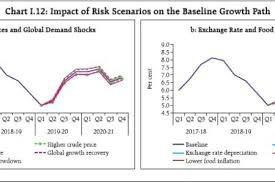

- Highlights of Economic Survey

- February 2020 - Exams Resources

- Current Affairs - Quiz

- Current Affairs - Test

- Current Affairs - PDF

Current Affairs February 2020 - Economic

1 - CBDT issued clarification on the new provision in Finance Bill 2020

Central Board of Direct Taxes has issued clarification on the Finance Bill, 2020. It has proposed that an Indian citizen shall be deemed to be resident in India if he or she is not liable to be taxed in any country or jurisdiction.

CBDT noted that the interpretation that Indians who are bonafide workers in other countries, including in the Middle East, and who are not liable to tax in these countries, will be taxed in India on the income that they have earned there is incorrect.

2 - January GST collection crossed Rs 1.1 lakh crore

The Goods and Services Tax (GST) monthly collections have crossed the Rs 1.1 lakh crore mark for the second time since implementation of the new tax regime in 2017. The gross GST revenue collected in the month of January, 2020 is Rs 1,10,828 crore of which CGST is Rs 20,944 crore, SGST is Rs 28,224 crore, IGST is Rs 53,013 crore (including Rs 23,481 crore collected on imports) and Cess is Rs 8,637 crore (including Rs 824 crore collected on imports).

It is also the sixth time that the monthly GST revenue has topped Rs 1 lakh crore. The total revenue earned by the centre and state governments after regular settlement in January 2020 is Rs 45,674 crore for CGST and Rs 46,433 crore for SGST.

3 - India bans exports of all kinds of personal protection equipment

India has banned exports of all kinds of personal protection equipment, including clothing and masks used to protect people from air borne particles.

The move assumes significance as there could be a spurt in demand for such products due to outbreak of novel Coronavirus in China.

The Directorate General of Foreign Trade, DGFT, has also banned imports of stock lot papers. These are kind of discarded, improper sized and unused papers. The move aims at cutting down imports of non-essential items into the country.

4 - Macro-economic Framework Statement (MFS) 2020-21 predicted rebound in GDP growth

Macro-economic Framework Statement (MFS) 2020-21 predicted rebound of GDP growth from the first quarter of 2020-21 despite a temporary moderation in the GDP growth in 2019-20 owing to global headwinds and challenges in the domestic financial sector.

Key points of MFS

Center revised the fiscal roadmap in the near term and limited the fiscal deficit to 3.8% of the GDP in RE 2019-20 and 3.5% in 2020-21.

Consumer price inflation remained within the targeted limits.

Major challenges for the economy arise from the external front such as rising crude oil prices.

5 - MSMEs turnover threshold for Audit increased 5 times to Rs 5 Crore

Union Budget proposed to raise by five times the turnover threshold for audit from the existing Rs. 1 crore to Rs. 5 crore so as to reduce the compliance burden on small retailers, traders, shop keepers who comprise the Medium, Small and Micro Enterprise (MSME) sector.

The increased limit shall apply only to those businesses which carry out less than 5% of their business transactions in cash, in order to boost less cash economy. Currently, businesses having turnover of more than Rs 1 crore are required to get their books of accounts audited by an accountant.

6 - Union Budget proposed to remove the Dividend Distribution Tax

In order to increase the attractiveness of the Indian Equity Market, to provide relief to a large class of investors and to make India an attractive destination for investment, the Union Budget proposed to remove the Dividend Distribution Tax and allow deduction for the dividend received by holding company from its subsidiary. The removal of DDT will lead to estimated annual revenue forgone of Rs. 25,000 crore.

Further, non-availability of credit of DDT to most of the foreign investors in their home country results in reduction of rate of return on equity capital for them.

7 - Tax Concessions announced for Sovereign Wealth Funds of Foreign Governments

In order to incentivize the investment by the Sovereign Wealth Fund of foreign Governments in the priority sectors, the Union Budget proposed to grant 100% tax exemption to the interest, dividend and capital gains income in respect of investment made in infrastructure and other notified sectors before 31st March, 2024 and with a minimum lock-in period of 3 years.

A sovereign wealth fund is a state-owned investment fund that invests in real and financial assets such as stocks, bonds, real estate, precious metals, or in alternative investments such as private equity fund or hedge funds.

8 - Deadlines for relaxation for affordable housing extended by one year

Finance Minister proposed to extend the date of loan sanction, for availing this additional deduction by one more year so as to ensure that more persons avail this benefit and to further incentivise the affordable housing.

For realisation of the goal of Housing for All and affordable housing, an additional deduction of up to one lakh fifty thousand rupees for interest paid on loans taken for purchase of an affordable house was announced in budget. The deduction was allowed on housing loans sanctioned on or before 31st March, 2020.

9 - 16 Action points to focus on farmers income proposed in budget

Union minister of Finance and Corporate Affairs Smt. Nirmala Sitharaman proposed 16 action points focusing on doubling farmers income in horticulture sector, food storage, animal husbandry and blue economy.

Action points are as follows:

To expand PM-KUSUM to 20 lakh farmers for setting up solar pumps and help another 15 lakh farmers solarise their grid connected pump sets.

To operationalize scheme to enable farmers to set up solar power generation capacity on their fallow/barren lands.

Integration of negotiable warehousing receipts (e-NWR) and National Agricultural Market (e-NAM).

Encourage balanced use of all kinds of fertilizers and Zero Budget Natural Farming (ZBNF).

10 - Union Budget 2020-21 allocated Rs.99300 crore for education and skill development

Union Finance and Corporate Affairs Minister, Smt Nirmala Sitharaman allocated a total outlay of Rs.99,300 crore for the education sector in 2020-21 and Rs.3000 crore for Skill Development. About 150 Higher Educational Institutions will start apprenticeship embedded diploma courses by March 2020-21 to improve the employability of students in the general stream.

A National Police University and a National Forensic Science University have also been proposed in the domain of policing science, forensic science, cyber-forensics, etc. In order to meet the requirement of qualified medical doctors, it is proposed to attach a medical college to an existing district hospital in PPP mode.

11 - IOC signed first term contract for Russian crude

Indian Oil Corporation has signed an agreement with Russia's state-owned firm Rosneft or exporting 2 million tonne of Urals-grade crude oil to India this year. Rosneft is also expected to bid for Indian government-owned Bharat Petroleum Corporation Ltd (BPCL).

The agreement is a part of Indias strategy for diversifying the countrys crude oil supplies from non-OPEC countries. The crude oil, being sourced under the contract, will be loaded in Suezmax vessels at Novorossiysk port of Russia and will come to India, bypassing Straits of Hormuz.

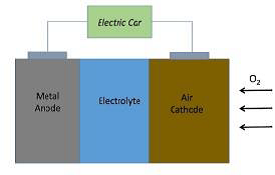

12 - IOC signed JV with Phinergy to produce metal-air batteries

Indian Oil Corp has bought a minority stake in Israel's Phinergy and signed a joint venture deal to produce metal-air batteries, an alternative to more mainstream lithium technology. The IOC and Phinergy will set up a joint venture in India to manufacture Al-Air batteries and to facilitate development of supporting infrastructure.

Al-Air battery technology would complement lithium-ion batteries to provide a hybrid solution for the large-scale adoption of electric vehicles.

13 - Eastern Railways partnered with Amazon India to set up kiosk

Amazon India entered into a partnership with Eastern Railways to set up a pick-up kiosk at the buzzing Sealdah railway station in Kolkata, West Bengal. The kiosk will be treated like a small open-fronted hut or cubicle from where newspapers, refreshments, tickets, etc., will be sold. The same initiative was also done by Mumbai across four railway stations.

Amazon.com, Inc. is an American multinational technology company based in Seattle. The Amazon India Shopping App markets over 17 crore products.

14 - Fitch predicted Indias GDP growth at 5.6% for Financial Year 2021

Fitch Ratings predicted Indias GDP growth of 5.6% in the next FY21 and affirmed India at 'BBB-' with a stable outlook in its India Economic Outlook. It expected growth to slow to 4.6% in the financial year ending March 2020 (FY20), from 6.8% in FY19. Fitch Ratings Inc. is an American credit rating agency and is one of the big three credit rating agencies.

Other predictions are:

Government debt will remain 70% of total GDP.

It expected growth to recover to 5.6% in FY21 and 6.5% in FY22.

Rise in risk of more significant fiscal loosening in the event of continued weak GDP growth.

15 - Fiscal Deficit of government touched 132% of full year target

The government's fiscal deficit touched 132.4% of the full-year target at December-end mainly due to slower pace of revenue collections.

Controller General of Accounts data unveiled the following facts:

Fiscal deficit or gap between expenditure and revenue was 9,31,725 crore.

Center restricted the gap at 3.3% of the GDP, or 7,03,760 crore, in the year ending March 2020.

The deficit was 112.4% of 2018-19 Budget Estimate

The governments revenue receipts were 11.46 lakh crore or 58.4% of the 2019-20 BE.

16 - India-China Trade Deficit

As per the data provided by DGCIS, Indias trade with China decreased from USD 89.71 billion in 2017-18 to USD 87.07 billion in 2018-19. During this period, Indias imports from China declined from USD 76.38 billion in 2017-18 to USD 70.32 billion in 2018-19 and exports grew from USD 13.33 billion in 2017-18 to USD 16.75 billion in 2018-19.

As a result, Indias trade deficit with China reduced from USD 63.05 billion to USD 53.57 billion in the said period.

17 - Decline in growth rate in Food and Grocery Retail Sector

As per NAS 2019 estimates, the food processing sector is growing at the annual average rate of 8.19% during the last five years ending 2017-18. Data on growth rate specific to retail (food & grocery) sector is not available. For promoting growth in food processing sector, the Ministry of Food Processing Industries (MoFPI) is implementing an Umbrella Scheme-PRADHAN MANTRI KISAN SAMPADA YOJANA (PMKSY) with an outlay of 6,000 crore for its implementation during 2016-17 to 2019-20.

MoFPI is also implementing the scheme "Operation Greens" under the PMKSY since November 2018 for integrated development of value/supply chain exclusively of tomato, onion and potato (TOP) crops in selected States on pilot basis.

18 - Birla Estates introduced LIDEA on WhatsApp for its customers

Birla Estates launched AI Powered ChatBot solution LIDEA for its customers. LIDEA is enabled to provide authentic information and answer the queries around Birla Estates developments and debuts with its Whitefield, Bengaluru project. LIDEA can enable the users to access authentic information of the projects which can be used for the evaluation of the residential developments of Birla Estates.

The artificial intelligence empowered Chatbot will also offer features like viewing location, configurations, amenities, virtual tours and accepting site visit requests.

19 - US surpassed China to become India's top trading partner

The United States has surpassed China to become India's top trading partner. According to the Commerce Ministry data, the bilateral trade between the US and India stood at nearly 88 billion dollars in 2018-19 fiscal. During the period, India's trade with China was at 87.1 billion dollars.

Similarly, during April-December 2019-20, the bilateral trade between the US and India stood at 68 billion dollars against a nearly 65 billion dollars trade with China in the same period. In 2018-19, India has a trade surplus of 16.9 billion dollars with America, but a deficit of 53.6 billion dollars with China.

20 - India ranked as second largest producer of crude steel

As per World Steel Association data, India became the second largest producer of crude steel after China in 2018 and 2019, by replacing Japan. India's crude steel production in 2018 was at 109.3 million tonnes, up by 7.7% from 101.5 million tonnes in 2017.

The production moved up to 111.2 million tonnes in 2019. China remains number one with 920 million tonnes of production in 2018 and 996.3 million tonnes in 2019. Japan ranks third globally with 104.3 million tonnes of crude steel production in 2018 and 99.3 million tonnes in 2019.

21 - SC directs telcos to pay AGR of Rs 1.47 lakh crore

The Supreme Court directed the Managing Directors and Directors of telcos and other firms to pay adjusted gross revenue (AGR) of 1.47 lakh crore rupees to the Department of Telecommunications, DoT. The legal battle over the AGR controversy, a nearly 15-year-old dispute, came to an end in October 2019, when the apex court ordered that the telecom companies pay over Rs 1.4 lakh crore including the original demand, interest and penalty charges.

Telecom companies had approached the Supreme Court in January, seeking modification in its verdict to get more time to pay up. The court had rejected the plea.

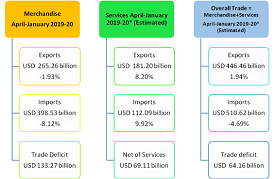

22 - INDIAS FOREIGN TRADE: January 2020

Indias overall exports (Merchandise and Services combined) in April-January 2019-20 are estimated to be USD 446.46 billion, exhibiting a positive growth of 1.94% over the same period last year. Overall imports in April-January 2019-20 are estimated to be USD 510.62 billion, exhibiting a negative growth of (-)4.69% over the same period last year.

Merchandise: Total exports was USD 265.26 billion down 1.93% while total imports was USD 398.53 billion down 8.12%. The trade deficit was USD 133.27 billion.

Services: Total exports was USD 181.20 billion up 8.20% while total imports was USD 112.09 billion up by 9.92%. The net of services was USD 69.11 billion.

Overall Trade; Total exports was USD 446.46 billion up by 1.94% while total imports was USD 510.62 billion down 4.69%. The trade deficit was USD 64.16 billion.

23 - WPI at 3.1% in January 2020

The official Wholesale Price Index for 'All Commodities' (Base: 2011-12=100) for the month of January, 2020 rose by 0.1% to 122.9 (provisional) from 122.8 (provisional) for the previous month. The annual rate of inflation, based on monthly WPI, stood at 3.1% (provisional) for the month of January, 2020 (over January, 2019).

The rate of inflation based on WPI Food Index consisting of 'Food Articles' from Primary Articles group and 'Food Product' from Manufactured Products group decreased from 11.05% in December, 2019 to 10.12% in January, 2020.

24 - CCI approved formation of a joint venture between Mahindra & Mahindra and Ford Motor

The Competition Commission of India (CCI) approved formation of a joint venture between Mahindra & Mahindra and Ford Motor and the transfer of the automotive business of Ford India to the joint venture. The proposed combination envisages the formation of a joint venture, namely Ardour Automotive Private Limited and the transfer of the automotive business of Ford India Private Limited (FIPL) to the joint venture.

In October 2019 M&M said it would buy 51% stake in Ardour Automotive Pvt Ltd for around 657 crore. The automotive business includes vehicle manufacturing plants of Ford India in Chennai and Sanand.

25 - India out of US developing nations list for trade benefits

The office of the US Trade Representative (USTR) removed India from its list of developing countries that are exempt from investigations into whether they harm American industry with unfairly subsidised exports. This makes India ineligible for benefits given by Washington to developing countries.

The United States Trade Representative eliminated other such nations such as Brazil, Indonesia, Hong Kong, South Africa and Argentina. India was removed from the list and declared as developed nation for being a G-20 member and having a share of 0.5% or more of world trade.

26 - Moody's Investors Service slashed India's growth forecast to 5.4% for 2020

Moody's Investors Service has slashed India's growth forecast to 5.4% for 2020 from 6.6% projected earlier. In its Global Macro Outlook, Moody's highlighted India's economy has decelerated rapidly over the last two years and expects economic recovery to begin in the current quarter.

The growth projections are based on calendar year and as per its estimates, India has clocked a GDP growth of 5% in 2019. Global GDP growth forecast has been revised down, and Moody's now expect G-20 economies to collectively grow 2.4% in 2020, followed by a pickup to 2.8% in 2021.

27 - India's sugar export may cross 5 million tonne

According to industry body ISMA, India's sugar export may cross 5 million tonnes in the marketing year ending September 2019, on higher demand from overseas amid a global deficit of 8-9 million tonne. For the current year, the government has allowed export of 6 million tonne of sugar under Maximum Admissible Export Quota to help deal with the surplus sugar.

The country's sugar production has reached nearly 17 million tonnes till February 15 of the current marketing year.

28 - Exports from SEZs achieve USD 100 Billion mark

The Special Economic Zones (SEZs) have achieved 100-billion-dollar worth of exports in FY 2019-20,as on 17th February 2020. The services segment was driver of the export growth at 23.69%. There was almost 4% growth in manufacturing segment also.

The other sectors which reflected healthy growth in this financial year include Gems & Jewelry (13.3%), Trading & Logistics (35%), Leather & Footwear (15%), Non-Conventional Energy (47%), Textiles & Garments (17.6%). Number of operational SEZs has grown to 241 as against 235 at the end of FY 2018-19.

29 - Centre released Rs 19,950 cr as GST compensation to states, UTs

The Central Government has released 19,950 crore rupees as GST compensation to states. With this release of GST compensation, the Central Government has released a total of over 1.20 lakh crore rupees towards GST compensation to the states during current fiscal.

In the financial year 2018-19, an amount of over 95,000 crore rupees was collected as GST compensation cess of which over 69000 crore rupees was released to the States and Union Territories as GST compensation.