- Appointments

- Awards

- Bills & Acts

- Books & Authors

- Deaths

- Defence

- Banking and Finance

- Environment

- Business and Economy

- Important Days

- International

- Miscellaneous

- National

- Persons in News

- Regional

- Reports

- Resignations

- Sports

- Science & Technology

- April 2019 - Exams Resources

- Current Affairs - Quiz

- Current Affairs - Test

- Current Affairs - PDF

Current Affairs April 2019 - Banking & Finance

1 - Government Raises Allahabad Bank Rs 8,000 Crore as Authorised Capital

State-owned Allahabad Bank stated that the government has increased its authorised capital by Rs 5,000 crore to Rs 8,000 crore. The central government after consultation with the Reserve Bank of India increased the authorised capital of the bank.

The increase in authorised capital will help enable the bank to raise further fund up to a maximum ceiling of Rs 8,000 crore.

Allahabad Bank has its headquarters in Kolkata and its Managing Director and CEO is Mr. S.S. Mallikarjuna Rao.

2 - Deposits In Jan Dhan Accounts Are Set To Cross Rs 1 Lakh Crore Mark

The total deposits in Jan Dhan Account are set to cross Rs 1 lakh crore soon. The scheme was launched on 28th August 2014 by the Modi-government with an aim to provide universal access to banking facilities to all households.

On 3rd April, the total balance in the Jan Dhan accounts was at Rs 97,665.66 crore and the total number of Jan Dhan accounts crossed 35.39 crores. Besides, more than 27.89 crores account holders have been issued the Rupay debit cards.

3 - Exim Bank Funds Projects Worth USD 267 mn In Rwanda

Exim Bank has provided soft loans of USD 266.60 million to Rwanda for various projects.

The funding, done in three separate tranches to Rwanda, is to support agricultural projects, development of special economic zones (SEZs) and for financing a road project in the African nation.

The capital city of Rwanda is Kigali and its currency is Rwandan Franc.

4 - IDRBT Sets Up 5G Lab For Banking, Financial Sector

The Institute for Development and Research in Banking Technology (IDRBT), an arm of Reserve Bank of India, has launched a 5G Use Cases Lab for banking and financial sector.

The 5G technology, along with blockchain, will be progressively adopted by banks. Department Of Telecommunications had already launched test beds for 5G use in the academia in Hyderabad, Chennai and Bangalore to develop 5G for Indian use.

5 - Banks Credit Growth Up 13.24% in FY2019: RBI Data

The financial year 2019 has ended on a relatively robust note for banks. They clocked a 13.23% year-on-year credit growth against 9.85% in FY2018.

According to the Reserve Bank of Indias scheduled banks statement of position in India, deposit growth, at 9.99% year-on-year in FY2019, was also better than the 6.15% in FY2018.

6 - TCS and Google Join Hands To Develop Industry-Specific Cloud Solutions

Tata Consultancy Services partnered with Google Cloud to build industry-specific cloud solutions.

TCS solutions on Google Cloud Platform (GCP) will help enterprises build secure, cloud-native analytics platforms that enable high levels of personalization, and are cost-effective, easy to maintain, and future ready.

The Chairman of Tata Sons in Mr. Natarajan Chandrasekharan, while the Head of Google is Mr. Sunder Pichai.

7 - RBL Bank Collaborates With CreditVidya For Improving Customer Experience

RBL Bank has partnered with credit profiler CreditVidya to improve the lender's customer experience.

Through this partnership, the private sector lender will be able to gain significant insights into its customer base.

RBL/Ratnakar Bank Limited is a scheduled commercial bank, with its headquarters in Mumbai.

8 - Emirates Islamic Becomes Worlds 1st Islamic Bank To Launch Banking Via WhatsApp

Emirates Islamic has announced the launch of Chat Banking services for customers via WhatsApp, marking a global first in the Islamic banking sector.

The banks customers will now able to conduct daily banking activities via WhatsApp in a seamless and hassle-free manner.

Established in 2004, Emirates Islamic, part of Emirates NBD Group, is one of the fastest growing banks in the UAE.

9 - BSE, HDFC Bank Tie Up To Strengthen Startup Platform

The BSE has signed a memorandum of understanding (MoU) with HDFC Bank with an objective to strengthen the BSE Startups platform.

The MoU has been signed to spread more awareness on the benefits of the listing of startups on this BSE startup platform.

The current MD and CEO of BSE is Mr. Ashishkumar Chauhan.

10 - RBI Issues Norms For Banks To Set Up Currency Chests

The Reserve Bank of India came out with guidelines for banks to set up new currency chests, which include a minimum area of 1,500 square feet for strong room.

The new chests should have a processing a capacity of 6.6 lakh pieces of banknotes per day. The currency chests should have CBL of Rs 1,000 crore, subject to ground realities and reasonable restrictions, at the discretion of the Reserve Bank.

Though the current headquarters of RBI is Mumbai, it was first founded on 1 April 1935 in Kolkata. The current Governor Shaktikant Das, is the 25th since its formation.

11 - Lakshmi Vilas Bank To Merge With Indiabulls Housing Finance

The board of Lakshmi Vilas Bank (LVB) approved the merger of the private sector lender with Indiabulls Housing Finance (IBH) through a share swap deal.

The merger will also enable Tamil Nadu-based LVB to obtain a larger geographical presence. The merged entity will have a net worth Rs19,472 crore and a loan book Rs1,23,393 crore for the nine months of FY19.

12 - BOB Becomes 3rd Largest Bank With Dena, Vijaya Merger

The amalgamation of Vijaya Bank and Dena Bank into the Bank of Baroda (BoB) has come into effect and all branches of the former two will function as branches of BoB.

Post the merger, Bank of Baroda has become the third largest bank in the country. The merged entity would also receive Rs 5,042 crore fund infusion from the government.

Headquartered in Vadodara, Gujarat, the current MD and CEO of Bank of Baroda is P. S. Jayakumar.

13 - RBI Sets NBFC-MFIs' Average Base Rate At 9.21% For April-June

The Reserve Bank set the average base rate to be charged from borrowers by non-banking financial companies (NBFCs) and micro-finance institutions (MFIs) at 9.21% for the first quarter of the next fiscal (April-June).

RBI, on the last working day of every quarter, comes out with the average of the base rates of the five largest commercial banks for the purpose of arriving at the interest rates to be charged by NBFC-MFIs to its borrowers in the ensuing quarter.

14 - HCL Completes Acquisition Of Strong-Bridge Envision

IT major HCL Technologies stated that its acquisition of US-based Strong-Bridge Envision has been completed. HCL had recently agreed to acquire the Seattle-based company to enhance its digital transformation consulting capabilities.

According to reports, the deal was worth 45 million dollars. Strong-Bridge Envision is now part of its global digital and analytics business called HCL Mode 2 services.

15 - Reliance Mutual Fund Launches Voice-Based Financial Transactions

Reliance Nippon Life Asset Management (RNAM) has joined hands with Google to enable the customers of Reliance Mutual Fund to carry out voice-based financial transactions.

With this, RNAM becomes the first company in India, to provide a conversational interface that would help customers regarding funds transactions.

16 - Kotak Mahindra Bank Becomes First Lender To Charge For UPI Use

Kotak Mahindra Bank (Kotak) stated that it will charge customers for UPI transactions starting 1st of May 2019. For each Kotak Bank account, the first 30 UPI fund transfers will be free, after which a charge will be levied on all fund transfers from the bank account.

This will be applicable across all platforms, including Paytm, PhonePe, Google Pay or Truecaller Pay among others. The bank will charge Rs 2.50 per transaction for an amount value below or equal to Rs 1,000, and Rs 5 per transaction will be levied for a payment value above Rs 1,000.

17 - Canara Bank, Canara HSBC OBC Life launch Webassurance

Canara Bank and its life insurance partner Canara HSBC Oriental Bank of Commerce Life Insurance launched Webassurance to enable its customers to purchase life insurance in a convenient and hassle-free way.

This Life Insurance is jointly owned by Canara Bank (51%) and Oriental Bank of Commerce (23%) and HSBC Insurance Holdings (26%), the Asian insurance arm of HSBC.

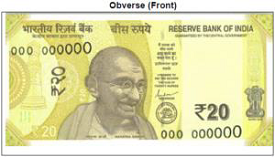

18 - RBI Introduces ₹ 20 Banknote In Mahatma Gandhi (New) Series

The Reserve Bank of India will shortly issue ₹ 20 denomination bank notes in the Mahatma Gandhi (New) Series, bearing the signature of Shri Shaktikanta Das, Governor, Reserve Bank of India.

The new denomination has the motif of Ellora Caves on the reverse, depicting the country's cultural heritage. The base colour of the note is Greenish Yellow. The dimension of the banknote will be 63 mm x 129 mm.

19 - Microsoft Becomes Worlds Third Company To Be Worth $1 Trillion

Microsoft has reached a valuation of one trillion dollars for the first time after posting an increase in profits. It makes the software giant only the third publicly-traded company in history to reach the threshold after Apple and Amazon passed it in 2018.

Microsofts current valuation also means that it has again taken over Apple as the worlds most valuable company.

20 - State Bank of India Launched Indias First Green Car Loan

State Bank of India (SBI) has launched Indias first Green Car Loan (Electric Vehicle) to encourage customers to buy electric vehicles. The new scheme Green Car Loan will offer the loan at 20 basis points lower than the interest rate on the existing car loan schemes.

SBI has already notified 100% migration to EVs (Electric Vehicles) by 2030 in order to decrease carbon footprints, thus being in line with the governments pledge of ensuring 30%EVs on road by 2030.