- Bank Management – Home

- Bank Management - Introduction

- Bank Mngmt - Commercial Banking

- Commercial Banking Functions

- Commercial Banking Reforms

- Bank Management – Liquidity

- Liquidity Management Theory

- Liabilities Management Theory

- Bank Management – Basle Norms

- Bank Mngmt – Credit Management

- Formulating Loan Policy

- Bank Mngmt – Asset Liability Mngmt

- Bank Mngmt – Evolution Of ALM

- Bank Mngmt – Risks With Assets

- Risk Measurement Techniques

- Bank Management – Bank Marketing

- Bank Mngmt – Relationship Banking

Bank Management - Commercial Banking

A commercial bank is a type of financial institution that provides services like accepting deposits, making business loans, and offering basic investment products. The term commercial bank can also refer to a bank, or a division of a large bank, which precisely deals with deposits and loan services provided to corporations or large or middle-sized enterprises as opposed to individual members of the public or small enterprises. For example, Retail banking, or Merchant banks.

A commercial bank can also be defined as a financial institution that is licensed by law to accept money from different enterprises as well as individuals and lend money to them. These banks are open to the mass and assist individuals, institutions, and enterprises.

Basically, a commercial bank is the type of bank people tend to use regularly. They are formulated by federal and state laws on the basis of the coordination and the services they provide.

These banks are controlled by the Federal Reserve System. A commercial bank is licensed to assist the following functions −

Accept deposits − Receiving money from individuals and enterprises known as depositors.

Dispense payments − Making payments according to the convenience of the depositors. For example, honoring a check.

Collections − Bank plays as an agent to collect funds from another banks receivable to the depositor. For example, when someone pays through check drawn on an account from a different bank.

Invest funds − Contributing or spending money in securities for making more money. For example, mutual funds.

Safeguard money − A bank is regarded as a safe place to store wealth including jewelry and other assets.

Maintain savings − The money of the depositors is maintained, and the accounts are checked and on a regular basis.

Maintain custodial accounts − These accounts are maintained under the supervision of one person but are actually for the benefit of another person.

Lend money − Lending money to companies, depositors in case of some emergency.

Commercial banks are apparently the largest source of financing for private capital investment in a nation, especially, like India. A capital investment can be defined as the purchase of a property with the purpose of either producing income from the property, increasing the value of the property over time, or both. Similar capital purchases made by enterprises may involve things like plants, tools and equipment.

Present Structure

The current banking framework in India can be broadly classified into two. The first classification divides banks into three sub-categories the Reserve Bank of India, commercial banks and cooperative banks.

The second divides the banks into two sub-categories scheduled banks and non-scheduled banks. In both of these systems of categorization, the RBI, is the head of the banking structure. It monitors and holds all the reserve capital of all the commercial or scheduled banks across the nation.

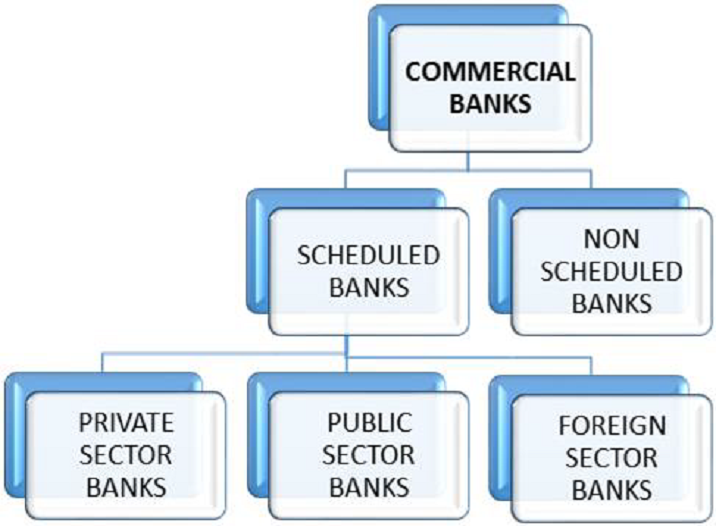

Commercial banks are the foundations that receive deposits from individuals and enterprises and lend loans to them. They generate credit. Commercial banks in India are regulate under the Banking Regulation Act of 1949. These banks are further categorized as −

- Scheduled banks

- Non-scheduled banks

Scheduled banks are banks which are listed in the 2nd schedule of the Reserve Bank of India Act, 1934. Non-scheduled banks are those banks which are not listed in the second schedule of the Reserve Bank of India Act,1934.

Scheduled Banks

In India, for a bank to qualify as a scheduled bank, it needs to meet the criteria as underplayed by the Reserve Bank of India. The following is a list of the criterions

- The banks should carry all their business transactions in India.

- All schedule banks are bound to hold a capital of not less than rupees five lakhs in the Reserve Bank of India.

- In the year 2011, five lakhs rupees calculated in terms of dollars amounted to $11,156.

Thus, any commercial, cooperative, nationalized, foreign bank and any other banking foundation that accepts and satisfies these set conditions are termed as scheduled banks but not all schedule banks are commercial banks.

The scheduled commercial banks are those banks which are included in the second schedule of RBI Act, 1934. These banks accept deposits, lend loans and also offer other banking services. The major difference between scheduled commercial banks and scheduled cooperative banks is their holding pattern. Cooperative banks are registered as cooperative credit institutions under the Cooperative Societies Act of 1912.

Scheduled banks are further categorized as −

- Private-sector banks

- Public sector banks

- Foreign sector banks

Private-Sector Banks

These banks acquire larger parts of stake or congruity is maintained by the private shareholders and not by government. Thus, banks where maximum amount of capital is in private hands are considered as private-sector banks. In India, we have two types of private-sector banks −

- Old Private-Sector Banks

- New Private-Sector Banks

Old Private-sector Banks

The old private-sector banks were set up before nationalization in 1969. They had their own independence. These banks were either too small or specialist to be incorporated in nationalization. The following is a list of old private-sector banks in India −

- Catholic Syrian Bank

- City Union Bank

- Dhanlaxmi Bank

- Federal Bank ING

- Vysya Bank

- Jammu and Kashmir Bank

- Karnataka Bank

- Karur Vysya Bank

- Lakshmi Vilas Bank

- Nainital Bank

- Ratnakar Bank

- South Indian Bank

- Tamilnadu Mercantile Bank

From the above mentioned banks, the Nainital Bank is an auxiliary or branch of the Bank of Baroda, which has 98.57% stake in it. A few old generation private-sector banks merged with other banks. For example, in the year 2007, Lord Krishna Bank merged with Centurion Bank of Punjab. Sangli Bank merged with ICICI Bank in 2006. Yet again, Centurion Bank of Punjab merged with HDFC in 2008.

New Private-sector Banks

Banks which started their operations after liberalization in the 1990s are the new private-sector banks. These banks were permitted entry into the Indian banking sector after the amendment of the Banking Regulation Act in 1993.

At present, the following new private-sector banks are operational in India −

- Axis Bank Development

- Credit Bank (DCB Bank Ltd)

- HDFC Bank

- ICICI Bank

- IndusInd Bank

- Kotak Mahindra Bank

- Yes Bank

In addition to these seven banks, there are two more banks which are yet to commence operation. They got the in-principle licenses from RBI. These two banks are IDFC and Bandhan Bank of Bandhan Financial Services.